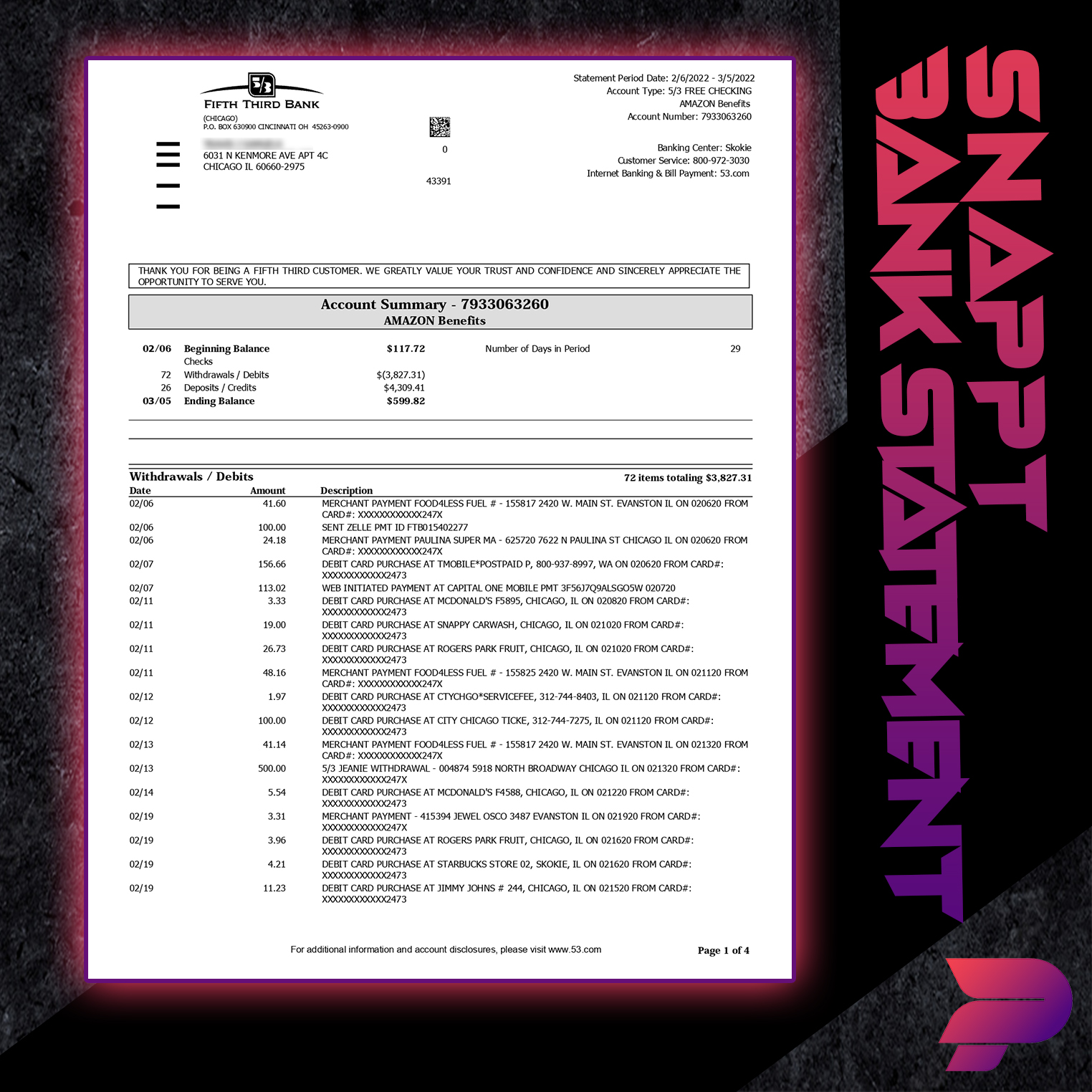

In today's fast-paced digital world, managing finances has become easier than ever thanks to innovative solutions like Snappt bank statement. This powerful tool helps individuals and businesses streamline their financial records, making it effortless to track expenses, generate reports, and maintain accurate records. Whether you're a small business owner or someone looking to organize personal finances, Snappt bank statement offers unparalleled convenience.

As financial management continues to evolve, many people are turning to digital tools to simplify their lives. Snappt stands out as one of the most reliable platforms for generating bank statements that meet various needs. From automating processes to enhancing security, this platform delivers exceptional value for users.

In this article, we will explore everything you need to know about Snappt bank statement, including its features, benefits, and how it can revolutionize the way you manage finances. Whether you're new to digital banking tools or a seasoned user, this guide will provide valuable insights into maximizing the potential of Snappt.

Read also:Where Is Colin Myers From Unveiling The Roots Of A Remarkable Figure

Table of Contents

- What is Snappt Bank Statement?

- How Does Snappt Bank Statement Work?

- Key Features of Snappt Bank Statement

- Benefits of Using Snappt Bank Statement

- Security and Privacy in Snappt Bank Statement

- Snappt Bank Statement vs Traditional Methods

- Integration with Other Financial Tools

- Pricing Plans and Packages

- Use Cases for Snappt Bank Statement

- The Future of Snappt Bank Statement

What is Snappt Bank Statement?

Snappt bank statement is a cutting-edge digital solution designed to help users create, manage, and analyze bank statements effortlessly. It leverages advanced technology to automate the traditionally time-consuming process of generating and maintaining financial records. This platform is ideal for both individuals and businesses seeking to enhance their financial management capabilities.

With Snappt, users can access their bank statements anytime and anywhere through a secure online portal. The platform ensures accuracy and reliability, providing detailed insights into transactions, balances, and other financial activities. By integrating seamlessly with various banking systems, Snappt bank statement eliminates the hassle of manual data entry and reduces the risk of errors.

Why Choose Snappt Bank Statement?

One of the standout reasons to choose Snappt bank statement is its user-friendly interface, which makes it accessible even for those who are not tech-savvy. Additionally, its robust features cater to diverse financial needs, from tracking daily expenses to preparing comprehensive reports for tax purposes. This adaptability ensures that Snappt remains a versatile tool for all users.

How Does Snappt Bank Statement Work?

Snappt bank statement operates by connecting directly to your financial accounts, securely retrieving transaction data and organizing it into structured statements. This process involves several steps, including authentication, data extraction, categorization, and presentation. The platform uses encryption and multi-factor authentication to safeguard sensitive information throughout the entire process.

Once connected, Snappt automatically updates your statements in real-time, reflecting the latest transactions and balances. Users can customize the format and content of their statements to suit their preferences, ensuring they receive the exact information they need. Furthermore, Snappt supports exporting statements in various formats, such as PDF and CSV, for easy sharing and archiving.

Step-by-Step Guide

- Sign up for a Snappt account and complete the verification process.

- Link your bank accounts using secure credentials.

- Set preferences for statement generation, including frequency and format.

- Access and review your statements through the Snappt dashboard.

- Export or share statements as needed for tax, audit, or other purposes.

Key Features of Snappt Bank Statement

Snappt bank statement boasts a wide range of features that make it an indispensable tool for financial management. These features are designed to enhance productivity, accuracy, and convenience for users. Below are some of the key features:

Read also:Catalina Bachelorette Party A Dream Getaway For Your Special Celebration

- Automated Statement Generation: Automatically create statements based on predefined criteria.

- Real-Time Updates: Stay up-to-date with the latest transactions and balances.

- Customizable Formats: Tailor the appearance and content of statements to meet specific requirements.

- Export Options: Export statements in multiple formats for easy sharing and storage.

- Secure Access: Ensure data privacy through advanced encryption and authentication protocols.

Advanced Features

In addition to the basic features, Snappt offers advanced functionalities such as transaction categorization, budget tracking, and financial analysis tools. These features empower users to gain deeper insights into their financial health and make informed decisions.

Benefits of Using Snappt Bank Statement

Adopting Snappt bank statement offers numerous benefits that contribute to improved financial management and overall efficiency. Below are some of the key advantages:

- Time Savings: Eliminate the need for manual data entry and streamline statement generation.

- Accuracy: Reduce errors by relying on automated processes for data collection and organization.

- Convenience: Access statements anytime and anywhere through a secure online platform.

- Cost-Effectiveness: Minimize expenses associated with traditional statement preparation methods.

- Security: Protect sensitive financial information with industry-leading security measures.

Enhanced Productivity

By automating routine tasks and providing instant access to accurate financial data, Snappt bank statement enhances productivity for both individuals and businesses. This allows users to focus on more strategic activities while leaving the mundane aspects of financial management to the platform.

Security and Privacy in Snappt Bank Statement

Data security and privacy are top priorities for Snappt bank statement. The platform employs state-of-the-art encryption technologies and adheres to stringent regulatory standards to protect user information. Multi-factor authentication ensures only authorized users can access sensitive data, while regular security audits help identify and address potential vulnerabilities.

Additionally, Snappt complies with global data protection regulations, such as GDPR and CCPA, ensuring that user rights are respected and upheld. Users can rest assured that their financial data is handled with the utmost care and confidentiality.

Security Measures

- End-to-end encryption for data transmission and storage.

- Multi-factor authentication for account access.

- Regular security updates and patches.

- Compliance with international data protection standards.

Snappt Bank Statement vs Traditional Methods

Compared to traditional methods of generating bank statements, Snappt offers significant advantages in terms of speed, accuracy, and convenience. Manual processes often involve tedious data entry, increased risk of errors, and limited accessibility. In contrast, Snappt automates these processes, delivering faster and more reliable results.

Furthermore, traditional methods may lack the advanced features and customization options available in Snappt bank statement. This makes Snappt a more versatile and efficient solution for modern financial management needs.

Comparison Table

| Aspect | Traditional Methods | Snappt Bank Statement |

|---|---|---|

| Speed | Slow and time-consuming | Fast and automated |

| Accuracy | Prone to errors | Highly accurate |

| Accessibility | Limited access | Anywhere, anytime access |

| Features | Basic functionality | Advanced features and customization |

Integration with Other Financial Tools

Snappt bank statement seamlessly integrates with a variety of financial tools and software, enhancing its utility for businesses and individuals alike. These integrations enable users to synchronize their financial data across multiple platforms, creating a cohesive ecosystem for managing finances.

Popular integrations include accounting software like QuickBooks and Xero, payment processors such as PayPal and Stripe, and expense management tools like Expensify. By connecting Snappt with these platforms, users can streamline workflows and gain a comprehensive view of their financial activities.

Supported Integrations

- QuickBooks

- Xero

- PayPal

- Stripe

- Expensify

Pricing Plans and Packages

Snappt bank statement offers flexible pricing plans to accommodate different user needs and budgets. These plans range from basic options suitable for individual users to advanced packages designed for large enterprises. Each plan includes a set of features tailored to the specific requirements of its target audience.

Users can choose between monthly and annual subscription models, with discounts available for long-term commitments. Additionally, Snappt provides a free trial period, allowing potential customers to explore the platform's capabilities before committing to a paid plan.

Pricing Overview

- Basic Plan: Ideal for individual users, includes essential features.

- Premium Plan: Suitable for small businesses, offers additional features and support.

- Enterprise Plan: Designed for large organizations, includes advanced functionalities and customization options.

Use Cases for Snappt Bank Statement

Snappt bank statement finds applications in various scenarios, catering to diverse user needs. Below are some common use cases:

- Personal Finance Management: Individuals can use Snappt to track expenses, monitor savings, and prepare statements for tax purposes.

- Small Business Accounting: Entrepreneurs can leverage Snappt to generate accurate financial reports and ensure compliance with regulatory requirements.

- Corporate Financial Analysis: Large organizations can utilize Snappt for detailed financial analysis and strategic decision-making.

Case Study: Small Business Success

A small business owner in the retail industry implemented Snappt bank statement to streamline their accounting processes. By automating statement generation and integrating with existing financial tools, the business reduced operational costs and improved accuracy in financial reporting. This led to increased efficiency and better-informed business decisions.

The Future of Snappt Bank Statement

As technology continues to advance, Snappt bank statement is poised to evolve and incorporate new features that enhance its capabilities. Future developments may include artificial intelligence-driven insights, enhanced data visualization tools, and expanded integration options. These innovations will further solidify Snappt's position as a leading solution for financial management.

In addition, Snappt aims to expand its global presence by supporting more currencies, languages, and banking systems. This will make the platform accessible to a wider audience, enabling users worldwide to benefit from its robust features and functionalities.

Kesimpulan

Snappt bank statement represents a revolutionary advancement in financial management, offering users unparalleled convenience, accuracy, and security. By automating the process of generating and maintaining bank statements, Snappt empowers individuals and businesses to take control of their finances with ease. Its robust features, flexible pricing plans, and seamless integrations make it an indispensable tool for modern financial management.

We encourage you to explore Snappt bank statement and experience its transformative capabilities firsthand. Share your thoughts and experiences in the comments below, and don't forget to check out our other articles for more valuable insights into digital finance. Together, let's simplify and enhance the way we manage our finances!