Sezzle has revolutionized the way people shop by offering interest-free "buy now, pay later" (BNPL) options. If you're wondering how to get cash from Sezzle, this article will provide detailed insights into the process and explore alternative solutions to meet your financial needs.

Many consumers are curious about whether they can convert their Sezzle credit into cash. While Sezzle is not designed as a cash advance service, there are strategies and methods to manage your financial situation effectively. In this guide, we'll explore everything you need to know about Sezzle and how to maximize its benefits.

Whether you're looking for short-term financial solutions or simply want to understand how Sezzle works, this article will cover all the essential aspects, including tips and alternatives for accessing cash. Let's dive in!

Read also:Tiktok Emojis Hehe The Ultimate Guide To Enhancing Your Content

Table of Contents

- What is Sezzle?

- Can You Get Cash from Sezzle?

- How Sezzle Works

- Alternatives to Getting Cash from Sezzle

- Sezzle Fees and Charges

- Does Sezzle Affect Your Credit Score?

- Tips for Using Sezzle Effectively

- Sezzle vs. Other BNPL Services

- FAQs About Getting Cash from Sezzle

- Conclusion

What is Sezzle?

Sezzle is a popular buy now, pay later (BNPL) service that allows customers to split their purchases into four interest-free payments over six weeks. It has gained significant traction among shoppers who want to manage their expenses without incurring interest charges.

Sezzle partners with thousands of online retailers, making it easy for consumers to use their service when shopping. By providing a flexible payment option, Sezzle helps users avoid high-interest credit card debt while still enjoying the convenience of purchasing items upfront.

However, it's important to note that Sezzle is not a cash advance service. Its primary purpose is to facilitate installment payments for purchases, not to provide direct access to cash.

Can You Get Cash from Sezzle?

While Sezzle does not offer a direct cash-out option, there are ways to indirectly access funds through strategic use of the service. Below, we explore whether it's possible to get cash from Sezzle and discuss potential solutions:

Understanding Sezzle's Business Model

Sezzle operates as a BNPL platform, meaning it focuses on enabling installment payments rather than offering cash advances. Unlike traditional lenders or payday loans, Sezzle does not provide cash directly to users. Instead, it allows shoppers to make purchases and pay them off gradually.

Possible Workarounds

- Gift Cards: Some merchants partnered with Sezzle sell gift cards. Purchasing a gift card using Sezzle could allow you to access funds indirectly.

- Reselling Items: If you buy high-demand products with Sezzle and resell them, you can effectively turn your purchases into cash.

- Peer-to-Peer Sales: Platforms like eBay or Facebook Marketplace can be used to sell items purchased via Sezzle, providing an alternative way to generate cash.

Keep in mind that these methods may involve additional fees or risks, so it's essential to weigh the pros and cons before proceeding.

Read also:Morgan Meinhart Zach Bryan The Rising Star In Country Music

How Sezzle Works

To fully understand the limitations and possibilities of getting cash from Sezzle, it's crucial to grasp how the service operates. Here's a breakdown of the Sezzle process:

- Sign Up: Create an account on the Sezzle website or app.

- Shop with Sezzle: Browse participating retailers and select items you wish to purchase.

- Split Payments: At checkout, choose Sezzle as your payment method and divide the total cost into four equal installments.

- Repayment Schedule: Payments are due every two weeks, starting two weeks after your purchase.

Sezzle's interest-free model makes it an attractive option for budget-conscious shoppers. However, it's important to stay on top of your payments to avoid late fees and maintain a good financial standing.

Alternatives to Getting Cash from Sezzle

If you're seeking cash but cannot use Sezzle for this purpose, consider these alternative solutions:

Personal Loans

Personal loans from banks or online lenders can provide a lump sum of cash with manageable repayment terms. Ensure you compare interest rates and fees to find the best option for your needs.

Credit Cards

Using a credit card with a cash advance feature can offer quick access to funds. Be cautious, though, as cash advances often come with high fees and interest rates.

Peer-to-Peer Lending

Platforms like Prosper or LendingClub connect borrowers with individual investors, offering competitive rates and flexible terms. This could be a viable option if you need cash quickly.

Sezzle Fees and Charges

While Sezzle prides itself on offering interest-free payments, there are certain fees associated with its service:

- Late Fees: If you miss a payment, Sezzle charges a late fee of up to $8, depending on the jurisdiction.

- Overdue Payments: Continued failure to make payments can result in additional penalties and potential account suspension.

It's essential to manage your Sezzle account responsibly to avoid unnecessary charges and maintain a positive financial reputation.

Does Sezzle Affect Your Credit Score?

Sezzle does not report payment activity to credit bureaus, meaning it won't directly impact your credit score. However, consistently missing payments could lead to collections actions, which might harm your credit standing in the long run.

To safeguard your credit score, always ensure timely payments and keep track of your Sezzle account activity.

Tips for Using Sezzle Effectively

Maximizing the benefits of Sezzle requires careful planning and responsible usage. Follow these tips to make the most of the service:

- Stick to Your Budget: Avoid overspending by setting limits on your Sezzle purchases.

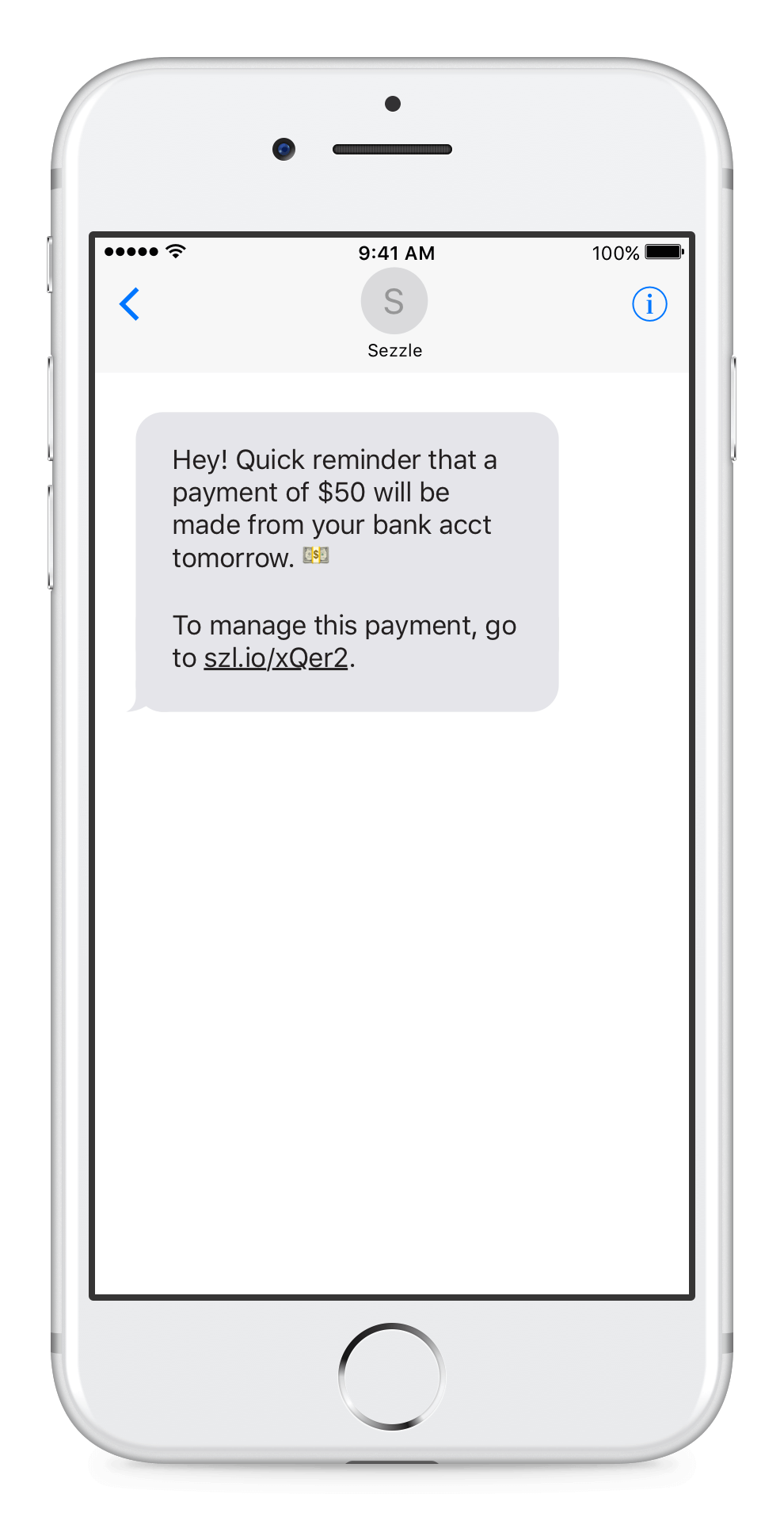

- Track Payments: Use Sezzle's built-in payment reminders to stay on top of your installments.

- Monitor Account Activity: Regularly check your Sezzle account for any discrepancies or errors.

By adopting these practices, you can enjoy the convenience of Sezzle without compromising your financial health.

Sezzle vs. Other BNPL Services

Sezzle competes with several other buy now, pay later platforms, each offering unique features and benefits. Below is a comparison of Sezzle with some of its top competitors:

Afterpay

Afterpay operates similarly to Sezzle, splitting purchases into four interest-free payments. However, Afterpay charges late fees of up to $10, slightly higher than Sezzle's fees.

Klarna

Klarna provides more flexible payment options, including "Pay in 4" and "Slice It" plans. While Klarna doesn't charge late fees, it may impose interest charges on overdue payments.

Affirm

Affirm offers fixed monthly payments with transparent interest rates. Unlike Sezzle, Affirm reports payment activity to credit bureaus, potentially helping users build credit over time.

FAQs About Getting Cash from Sezzle

Here are some frequently asked questions about accessing cash through Sezzle:

Can I Use Sezzle for Everyday Expenses?

No, Sezzle is designed for specific purchases at partnered retailers. It cannot be used for everyday expenses like groceries or utility bills.

Are There Any Hidden Fees?

Sezzle does not charge hidden fees. However, late payments may incur penalties, so it's crucial to adhere to the repayment schedule.

Can I Increase My Sezzle Limit?

Yes, Sezzle users can request a credit limit increase by demonstrating responsible payment behavior and maintaining a positive account history.

Conclusion

In summary, Sezzle is a valuable tool for managing purchases through interest-free installment payments. While it doesn't offer a direct cash-out option, creative strategies like purchasing gift cards or reselling items can help you access funds indirectly. Always remember to use Sezzle responsibly and explore alternative solutions if you require cash.

We encourage you to share your thoughts and experiences in the comments below. For more informative articles on personal finance and budgeting, explore our other content and stay updated on the latest financial trends!